|

There are two basic reasons why companies should take advantage of the services of a reputable barter company:

1) The company wants to recover as much value as possible from some undervalued asset, such as an excess inventory, or an underutilized service; or

2) A company wants to purchase certain advertising or travel services, but does not have the necessary cash flow.

|

Excess Inventories

Consider the case of a company with an inventory of obsolete, closed out, refurbished or otherwise excess products. The traditional solution to this problem is to discount the product and liquidate it for cash. This may move it out of the warehouse, but the company risks several consequences: Excess Inventories

Consider the case of a company with an inventory of obsolete, closed out, refurbished or otherwise excess products. The traditional solution to this problem is to discount the product and liquidate it for cash. This may move it out of the warehouse, but the company risks several consequences:

1) Loss of Profits. Discounting the product makes the company less profitable. In many cases the price has to be dropped below cost, which results in a financial loss.

2) Loss of Dealer Loyalty. Selling product at a lower price may upset dealers who recently purchased the same product at the original higher price. These customers may insist on the lower price for the product they have already purchased. Or worse, they may transfer their business to a competitor.

3) Loss of Control. If the product is liquidated outside the dealer network, the company can lose control of its product. The liquidated merchandise might be sold via some method that would tarnish the company's image.

If your company faces an excess inventory problem and you want to avoid all of these potential problems, then you should investigate barter!

|

Problem |

Barter Program Solution |

|

Loss of Profits |

Any barter program will

return more value for the product

than a cash liquidation. Barter can even recover

the original wholesale price,

including the full anticipated profit. |

|

Loss of Dealer Loyalty |

Product TAHO acquires is often used to trade with

the media for use in premium and

incentive programs. If TAHO iquidates for cash, it is never sold without

writen permission from our client.

We'll even work with you to

develop special incentive

programs that will INCREASE

customer loyalty. |

|

Loss of Control |

The Hackel Organization will

contractually guarantee to give its

client the right of final approval

over who receives its product and

how that product is remarketed.

Sensitive merchandise can be is shipped

directly by the client to the buyer. |

Using Barter to

Expand Cash Budgets

Another reason to consider barter is if a company wants to promote a product or service, yet does not have the necessary cash to buy advertising. In this event, the company can purchase the required advertising through a barter company and pay all or part of the cost with its product or service.

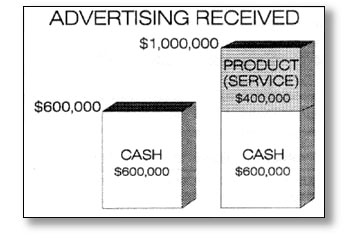

If the company has some cash budgeted for advertising, it can add product (or services) to that cash and receive additional advertising without having to spend additional cash. For example, a manufacturer might find that its $600,000 cash budget is inadequate. That manufacturer might be able to buy $1,000,000 of useful advertising through a barter firm and pay for it with $600,000 in cash and $400,000 in product valued at the full wholesale price.

Depiction of the advertising value received when bartered products (or services) are added to an existing cash budget.

Using Barter as 100% Payment

for Advertising

When a company has NO cash to spend on advertising, barter can help them continue to promote their product. This type of barter is generally called "Straight Trade" because the customer is paying for advertising completely with its product or service. No cash is required.

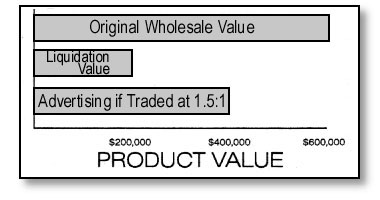

It should be noted that it is rare when a barter company can accept $1 of product in exchange for $1 of advertising. Usually some type of ratio is required. This can range from 1.25:1 to as much as 2.5:1. In other words $1 of advertising can cost anywhere from $1.25 to $2.50 in products or services.

What determines this ratio? There are two factors:

1) the value of the product; and 2) the cost of the advertising. If a manufacturer desires certain advertising that is very costly for the barter company to acquire and is only willing to use undervalued (excess or closeout) merchandise as payment, then the ratio will be high. Even with a high ratio, using the excess product to pay for advertising will generally return more value than liquidating the merchandise for cash.

For example, consider a manufacturer with an inventory that was originally worth $600,000 at full wholesale value. It is not unusual for closeout merchandise to be liquidated at 1/3 its normal price. The cash liquidation value of this inventory would be $200,000. If the same inventory was exchanged for advertising at a 1.5:1 ratio, the manufacturer would receive $400,000 in advertising. In other words, in this example barter returned twice value of the cash liquidation.

Summary

If your company needs to recover as much value as possible from its undervalued products or services; or if your company needs to buy advertising but doesn't have the necessary cash, then barter should certainly be investigated.

A Brief History || Financial Advantages of Barter || Delivery of Advertising || Trade Credits || Credential Letters || Why Barter || Request Client Reference || Links ||

Contact Us

An International Trading Company Established in 1954

1330 Centre Street, Box 69, Newton Centre, Massachusetts 02159

617-965-4400 FAX 617-527-6005

|